Determining gross margin

This calculator will assist you in determining an estimate of both your gross salary and the amount withheld from payments made to you in your capacity as a payee in situations such as. It is equal to earnings before interest tax depreciation and amortization EBITDA.

What Is Gross Margin Definition Formula And Calculation Ig Uk

Profit margins can be trickyboth determining them and understanding whats right for your business.

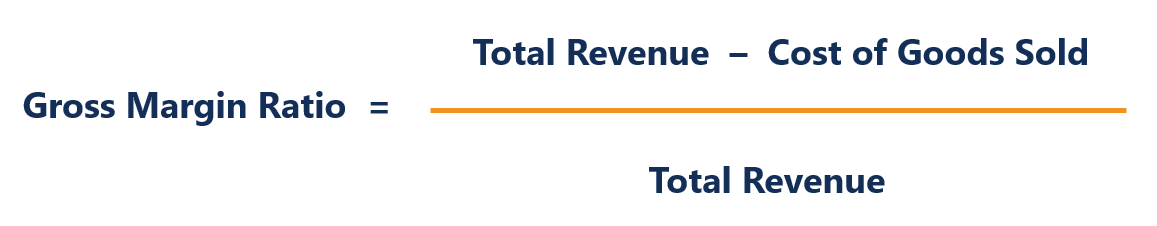

. And the willpower to keep accurate accounting records are essential factors in determining whether o. The calculation is sales minus the cost of goods sold divided by sales. A markup is an extra amount that a retailer adds to the cost of production when determining the customer-facing price of a product or service.

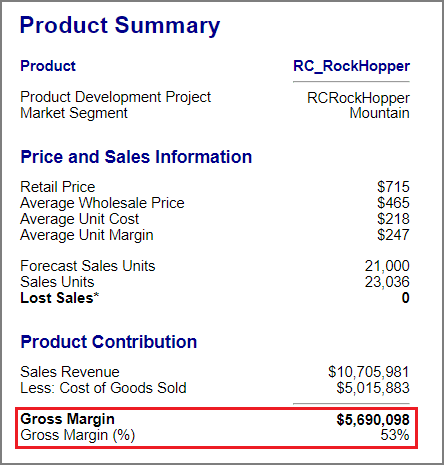

Selling marketing administrative expenses taxes and other costs have not been deducted before determining gross profit. Gross Margin Revenue - Cost of Goods Sold. Total sales after the cost of goods sold has been accounted for.

Just like a margin markup can be. Suppose your business makes 100 in revenue. Margin Protection MP is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin.

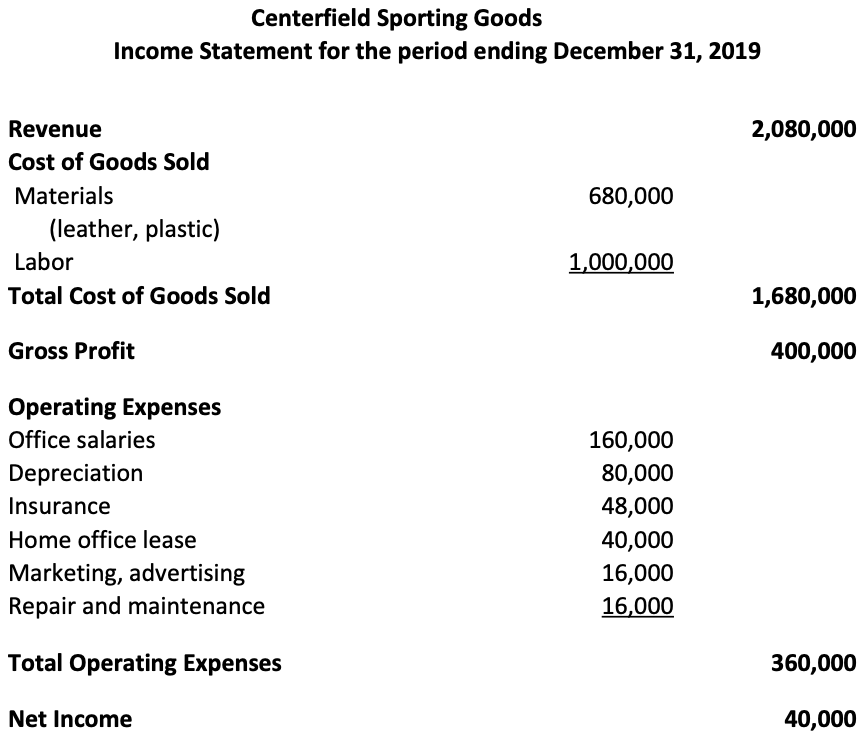

Perhaps the most used accounting tool to analyze profit margin is the income statement. Gross profit margin is the percentage of profit vs. The gross profit margin percentage doesnt account for other expenses like labor cost or operating expenses.

List of business and finance abbreviations. Determining the breakeven point and the target income. This is the simplest metric for determining profitability and one of the most widely used financial ratios.

Gross Profit Margin 70000 150000 Gross Profit Margin 46 Step 3. Determining costs requires keeping records of goods or materials purchased and any discounts on such purchase. The gross profit margin ratio would be Gross profit margin ratio Gross profit Net sales revenue x 100 300000 500000 x 100 60.

Gross Profit Margin Gross Profit Net Sales. Senator Warren among others argues that firms maximize. It is known as gross margin.

Gross income is also known as gross profit or gross margin. Calculate gross profit margin. A good profit margin means a business is very profitable.

When speaking about a monetary amount it is technically correct to use the term gross profit. The control system involves budgeting expenses and then determining the reasons for the differences between budgeted and actual expenses. So as per formula Net profit margin ratio Net income Revenue x 100.

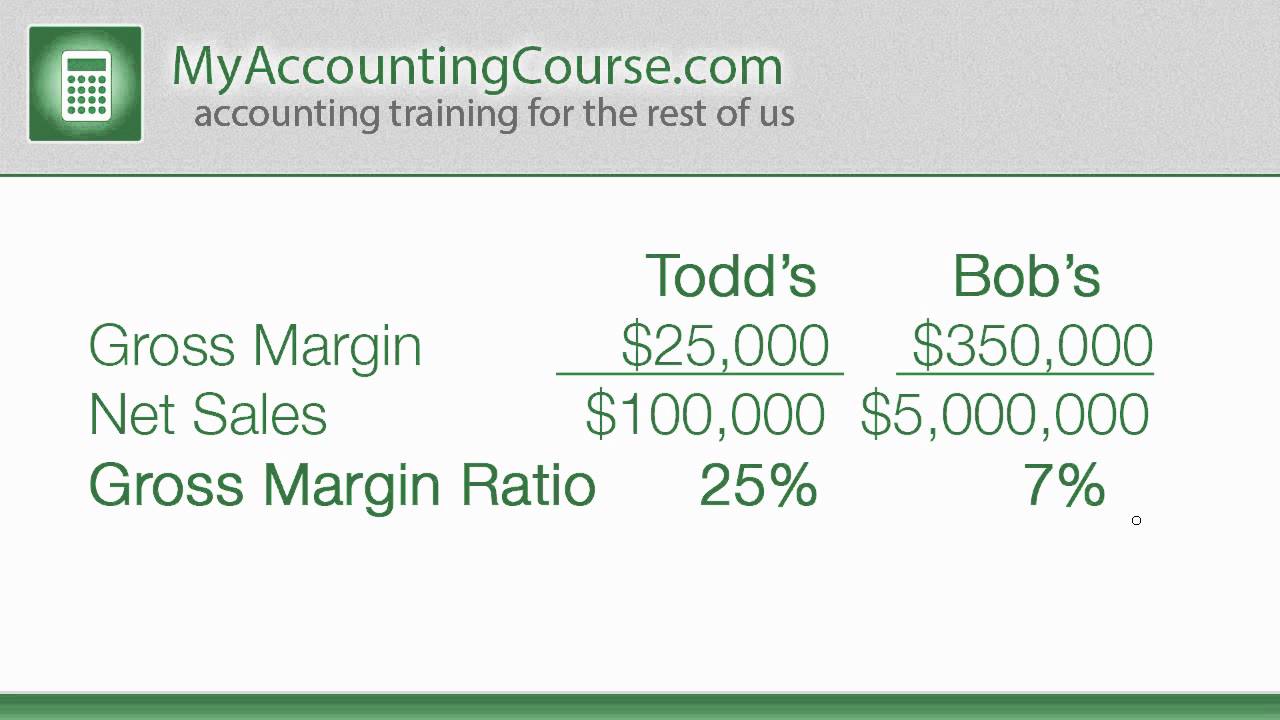

Then remedial action should be carried out to ensure that expenses are controlled in the future. For example if your profit margin is 17 your gross profit for every dollar. When referring to a percentage or ratio it is correct to use gross margin.

These core financial ratios include accounts receivable turnover ratio debts to assets ratio gross margin ratio etc. However there is one financial ratio that you often overlook. Also known as your gross profitand related to price pointthis figure.

Similarly the net profit margin ratio would be Net profit Gross Profit Expenses Rs. In other words gross margin is a percentage value while gross profit is a monetary. Gross income or gross profit margin is the most basic statistic of a companys profitability.

300000 83000 Rs217000. Generally the gross income is calculated as a proportion of its revenue. Expressed as a ratio profit margin subtracts the cost of expenses from total sales revenues then compares this result to the same sales total.

But it is quite useful to understand your business performance. This margin is useful for determining the results of a business before financing costs and income taxes. For example if sales are 100000 the cost of goods sold is 60000 and operating expenses.

SEOUL South Korea August 10 2022--Coupang Announces Q2 Record Gross Profit of 12 billion and Gross Profit Margin Improvement of 250 bps over Q1. MOUNTAIN VIEW Calif. Lets start with your gross profit margin.

Gross margin is often used interchangeably with gross profit but the terms are different. Gross Margin is the total sales revenue minus the cost of goods sold COGS divided by total sales. When all the firms expenses have been deducted the result is net profit the bottom-line.

The percentage you calculate is the amount of each dollar you keep after making a sale. Its also a great way to get started when assessing any income statement. The gross margin represents the amount of total sales revenue that the company retains after incurring the direct costs COGS associated with producing the goods and services sold by the company.

EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. Determining why business is good at the time your companys on an upward trajectory is easier than trying to figure it out later. Therefore any change that increases sales or decreases expenses results in an increased profit margin.

A high gross margin across several years of data means that your business is generating profitability from the efficient. It is usually expressed as a percentage. Determining gross margin is an easy and straightforward way to understand the core elements of a business.

Combine the variables to determine the gross margin. The plan provides coverage that is based on an expected margin which is the expected area revenue minus the expected area operating costs for each applicable crop type and practice. The introduction of Senator Elizabeth Warrens D-MA Real Corporate Profits Tax has put a spotlight on the differences between book income or the amount of income reported by corporations on their financial statements and the tax codes definition of income upon which the corporate income tax is assessed.

Income tax in the US. But as we have already discussed those wont be your only outgoings. Gross profit margin indicates the profitability of a business and is a measure of a businesss financial health.

Do your research for your industry and make sure to. Thus it focuses on the real results of a business. This is the contribution margin ratio.

The FBA calculator is great thanks Jeff for determining your FBA fees. Reacting quickly to an increase in sales also allows you to determine what you need to keep doing to sustain that growth. After determining the total revenue and cost of goods sold combine these variables in the equation to calculate gross margin.

Gross Margin Definition For B2b Saas Kpi Sense

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

How Do I Calculate Gross Margin Smartsims Support Center

Gross Margin Ratio Formula Analysis Example

What Is The Gross Profit Margin Bdc Ca

Gross Profit Margin Formula Meaning Example And Interpretation

Gross Margin What It Is Formulas And Some Examples

What Is Gross Margin And How To Calculate It Article

Gross Profit Margin Vs Net Profit Margin Formula

Gross Profit Margin Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

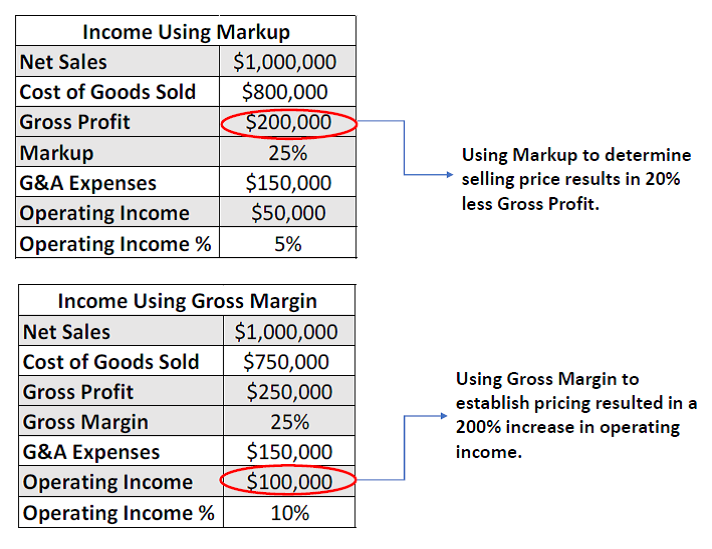

Gross Margin Vs Markup Cogent Analytics

Gross Margin Baremetrics

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Margin Ratio Formula Analysis Example

Margin Calculator